Developing Your Business Plan

Business Opportunity Assessment

A Business Opportunity Assessment takes a studied view of the factors that influence a project in given markets and identify risks that might derail a project from achieving commercialization. These often include intellectual property, ownership of the idea, market size and trends, outside influences, regulatory issues, revenue limitations, and current and alternative solutions being used by customers.

Understanding the project in the context of identified threats and opportunities, reveals insight that informs a decision to move forward with the next step towards a commercialization effort. Competitors and prospective customers enlighten the innovator as to where and how they currently buy their products and how they obtain after-the-sale service.

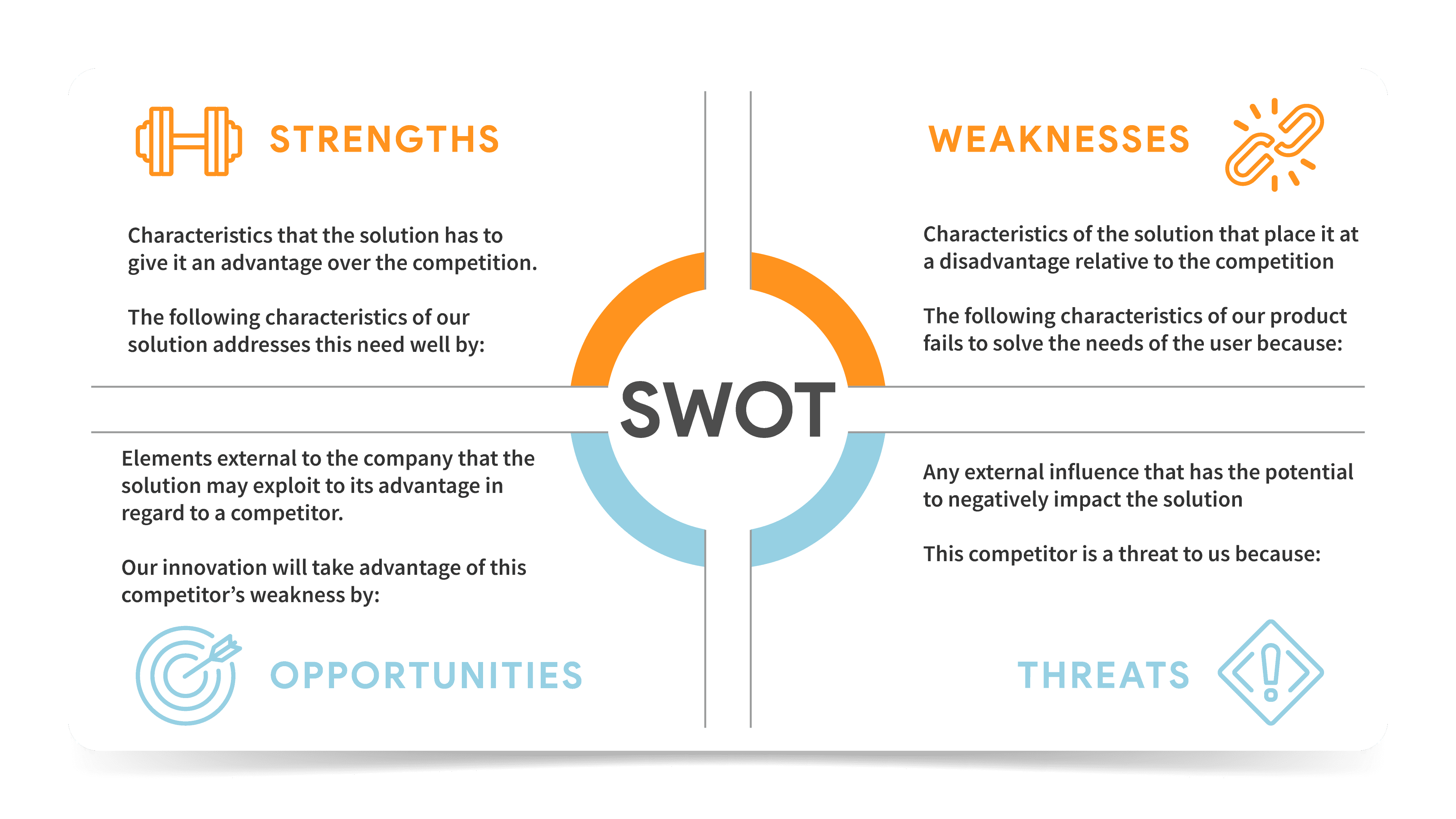

A structured review of these competitive solutions is accomplished by conducting a SWOT (Strength, Weakness, Opportunity, and Threat) analysis. SWOT analyses are used in business strategic planning when decisions about direction, policy or operations need to be made. By performing this analysis on competitors and including the customer’s point of view, insight and direction on how to develop, differentiate and promote the new technology will be gained.

Commercialization Strategy

“What doesn’t kill you, makes you stronger” is fine for an exercise routine, but in medical device commercialization, wasted resources, wrong product features, assumptions about adoption, buying, using or any reason at all, has the potential to end your commercialization attempt.

We mitigate errors like those described by embarking on a path to discover what is not known. This uncovers risks that are not known and permits an opportunity to overcome those risks when they are easy and relatively inexpensive to fix and therefor avoid altogether.

Customer Identification & Discovery

Much as is thought to be known as to who the customer is, every project has twists and turns that result in a shifting landscape. To overcome this undulating hurdle, it is imperative to identify the problem or need from the perspective of each stakeholder who influences the buying decision. Medical device selection, approval and adoption likely have additional stakeholders who have some level of influence, these could include internal clinical review groups, hospital administration, hospital or clinic quality committees, department heads, safety committees, and those involved with distribution or reimbursement. Bring all these opinions to light in order to learn from them what is required for a product/process to be successful in their eyes, which leads to their support.

Business Model Development and Verification

How a project transforms from an idea into a revenue generating business requires careful consideration because it doesn’t happen by accident. Existing problems have existing solutions. People don’t like change. To overcome inertia (and get someone to pay for the device) the new business needs to understand what outcome would be better than the existing solution. What innovators often do not take into consideration is that their stakeholders fit into an existing business model for some other business that is also vying for the same customer dollars. At a minimum, that business model needs to be understood. Then, devising a replacement business model (which includes the transformed idea into a product needs to consider all the elements necessary to create and deliver that product. The greater this is understood prior to prototyping the less resources will be needed to create a market ready product.

Financial Planning and Fundraising Guidance

Without funding, none of the above or aforementioned activities will be accomplished in a timely manner or at all. The need for translational funding varies based on the how far along the development pathway the project is. As a starting point, understand that funding which originates from beyond your own bank account falls into two categories. It is either dilutive or non-dilutive.

When a potential investor wants to give you cash, they want something in return. If what they want is a percentage of ownership, this is described as dilutive funding. Dilutive funding results from investments made by Angel investors, Angel groups, Venture funds, partnerships and possibly family/friends. Dilutive funding refers to a watering down of your ownership percentage. If you are the sole owner, you start off with 100% of the equity of the newly formed company. If there are two owners, you will need to come to an agreement as to who owns what percentage of the company and this agreement may take the form of a partnership agreement (not covered in this guide). Dilutive funding will reduce your equity from 100% to something less. How much less is based on a number of factors; company valuation, amount of investment (equity) which is being infused to the company and risk of failure. Cash or investment for which an investor does not want a percentage of ownership in return for is called non-dilutive funding. Examples of non-dilutive funding includes grants, debt, and gifts. Non-dilutive funding doesn’t affect your ownership percentage.

Product Market Definition

Product Market document (PMD) is repository of all the business model and customer interviewing information described into concise statements of customer needs. The PMD ensures that all future product development activity is based on customer desires, to create a technology they see value in. The PMD outlines the goal of the product or enhancement, who makes up the target and addressable markets, how the innovation fits into the workflow of users, and potential risks to successful implementation and adoption of the product.

The PMD articulates what the customer wants in the areas of key product capabilities, performance metrics, distribution, documentation and geographic requirements. PMD reduces risk toward the project in two significant ways; 1) it focuses product development on features and benefits that the customers find value in, 2) it ensures that capital and resources are focused on developing features and benefits that are directly related to identified customer value instead of features and benefits that customers will not appreciate or value. With development focused in this way, the end product should be something customers are willing to buy.